ALERTS

The stock squeeze alert feature provides real-time notifications when a stock shows signs of a potential squeeze, allowing you to potentially capitalize on sudden price increases.

Please note, this service is for Intermediate and Advanced traders ONLY. Alerts are not an indication to take immediate action

How to use ALERTS

With more than 50+ ALERTS each week here are a few suggestions on how one could use them.

Step 1

Receive the Alert and check the chart, if the stock is already squeezing then wait and be ready to act quickly on the next dip or support level.

*(Alerts during the last few minutes of regular trading hours can safely be ignored. These are usually reconciliation trades that give false volume spikes)

Step 2

Check the SqueezeFinder Live Watchlist or Ticker Search and make sure the stock still has good scores, also make sure the current price is far below the Juice Target.

Step 3

Check the chart and make sure the stock is trending up. Higher lows and higher highs over the last few days/weeks.

Step 4

Scale into the trade – WE NEVER BUY A HUGE GREEN CANDLE! We also never buy higher than the price from the Alert. We might open a small starter but then we wait for a pullback to buy more. Ideally, we want to see a 50% retracement if there has been a big move already.

We always scale INTO and OUT OF a position. If we FOMO in or out of a trade, we can lose money!

Step 5

Know the profile of the stock. If it’s a small cap, then the squeeze might only last a few hours or a day. If it’s a large cap, then the stock might take a few days or even weeks to fully squeeze.

For example, the alert may fire on a Monday and the squeeze won’t happen until Wednesday. If a week has gone by with no activity, we will probably cut the trade.

Alert Types

SCANNER ALERTS

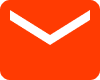

When a stock ticker triggers squeeze catalysts you’ll receive instant EMAIL and DISCORD alerts as soon as we detect signs of an impending squeeze. Stay informed and potentially profit from unexpected market movements.

Keep an eye out for these scanner alerts:

Bullish Breakout Swing = New highs and strong volume using long candles (few days or week hold)

Bullish Breakout Scalp = New highs and strong volume using short candles (short hold or daytrade)

Bullish Reversal Swing = Momentum change from Bearish to Bullish

QQQ Bullish/Bearish Reversal = Momentum change on the Nasdaq 100 (broad market direction)

Alert Types

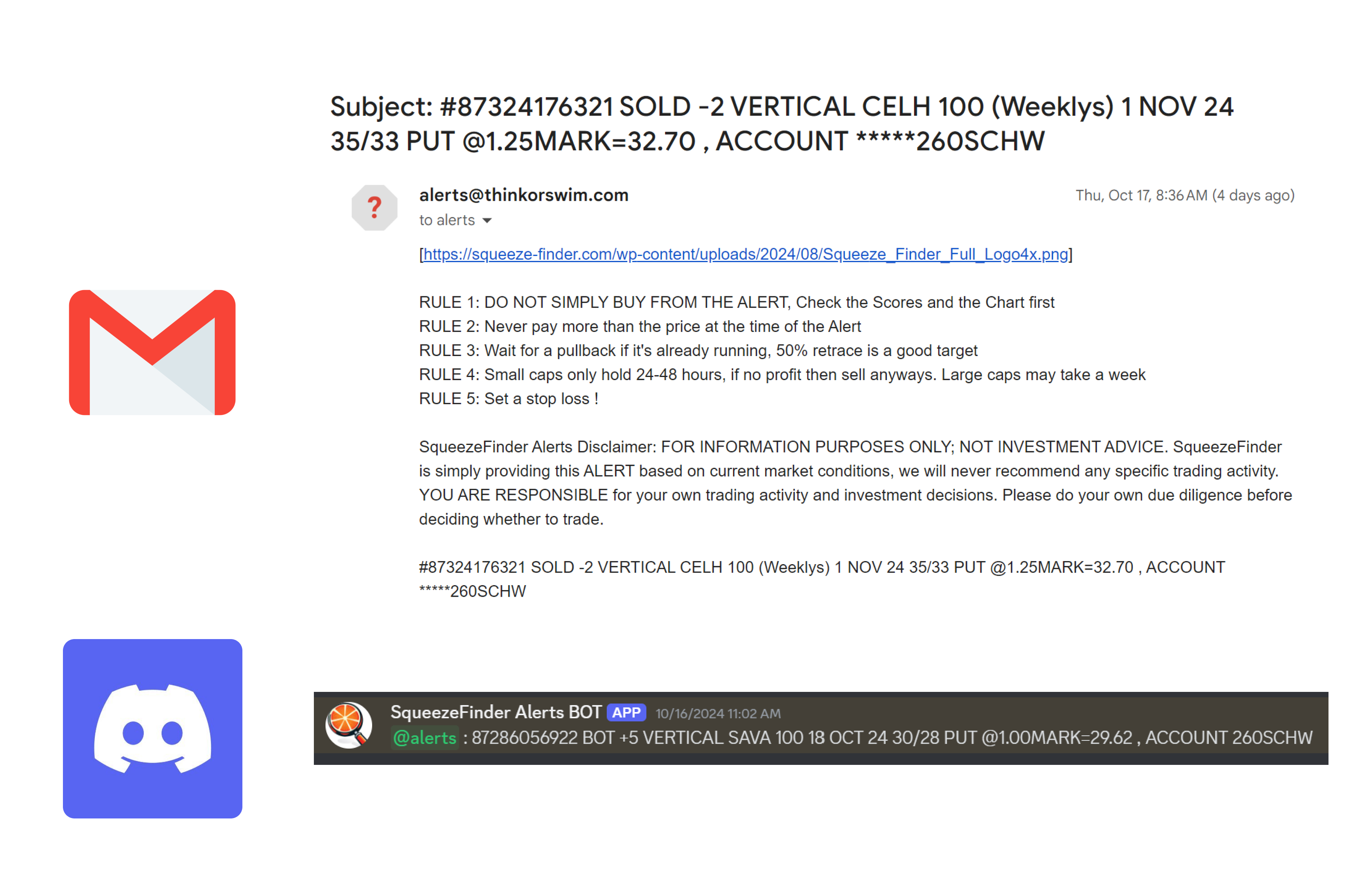

TRADE ALERTS

When a large transaction happens between a specific asset the ALERTS system may notify you via EMAIL and DISCORD alerts. These trades may be indicative of a potential change in the behavior of the asset.

For instructions on how to read ThinkOrSwim syntax click here:

*The projections or other information generated by SqueezeFinder regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results.