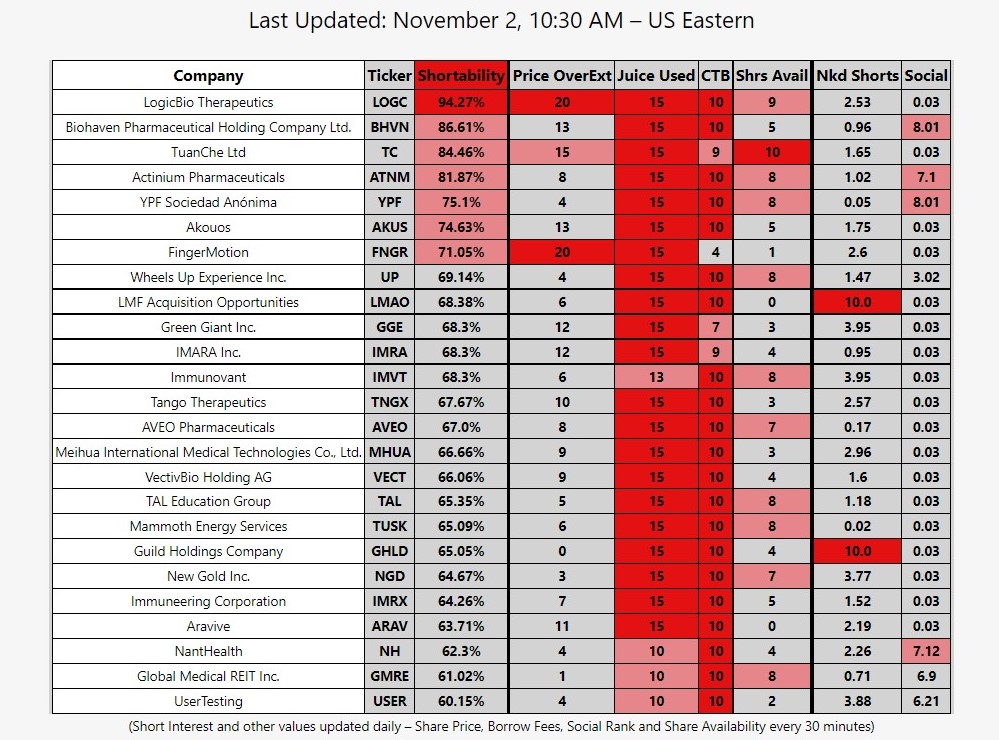

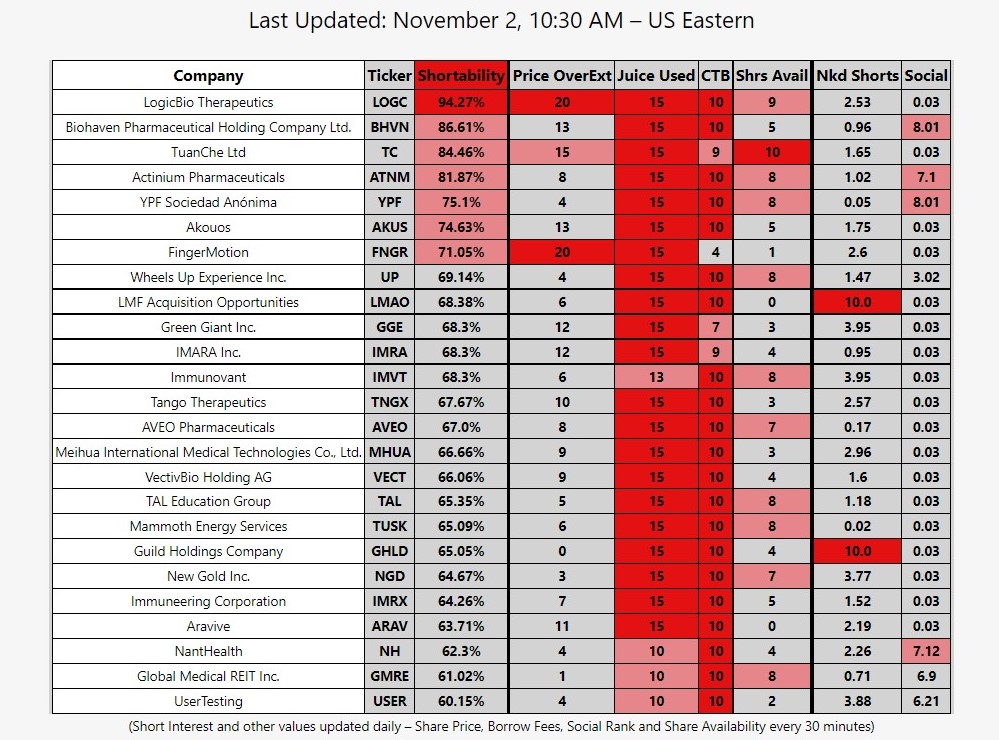

A revolutionary new screener that uses Short Interest data along with recent price action to find stocks that are priced much higher than they should be. The tickers on this watchlist are candidates for a short position.

© 2025 Squeeze Finder

A revolutionary new screener that uses Short Interest data along with recent price action to find stocks that are priced much higher than they should be. The tickers on this watchlist are candidates for a short position.

This is the average…

This score compares the current…

This score calculates the amount…

This score is the opposite…

This score is the opposite…

This score is the opposite…

This score is looking for…

DISCLAIMER:

FOR INFORMATION PURPOSES ONLY;

NOT INVESTMENT ADVICE.

SqueezeFinder is simply providing data and information, we will never recommend any specific trading activity. YOU ARE RESPONSIBLE for your own trading activity and investment decisions. Please do your own due diligence before deciding whether to trade. The projections or other information generated by SqueezeFinder regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. By subscribing, you agree that you have read, understand, and agree to the preceding statements.