July 1, 2025

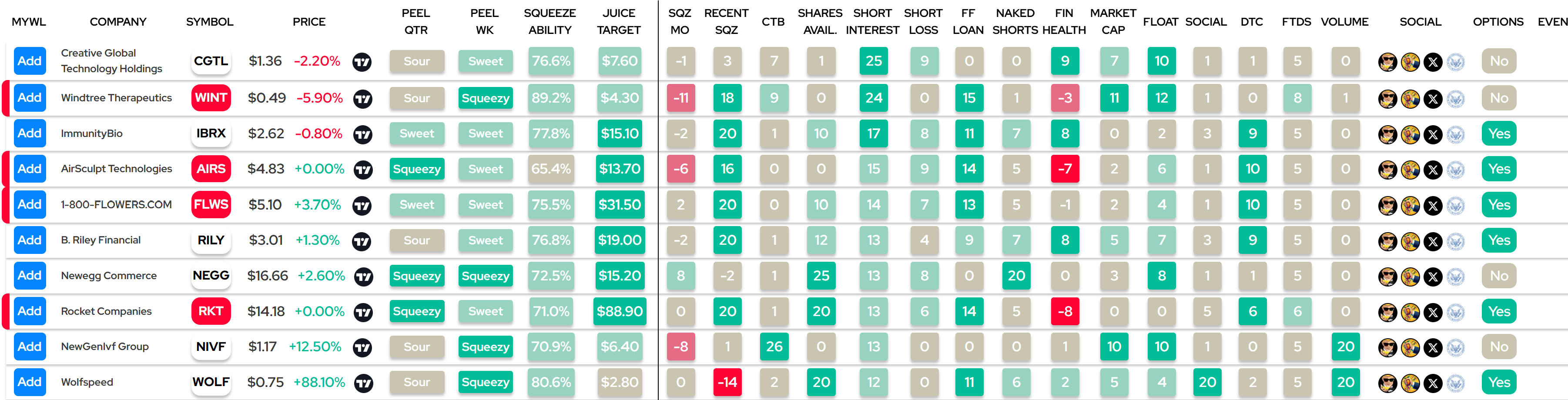

Investors hunting for the next big short squeeze are eyeing these ten stocks that surfaced on Squeeze Finder’s Monday Top 10 list. Here’s a closer look at each stock’s squeeze metrics and the latest headlines shaping their outlook. Written by Jim. B.

Creative Global Technology Holdings (CGTL)

Creative Global Technology Holdings closed at $1.36, down 2.20%. It shows a squeeze ability of 76.6%, with a juicy upside target of $7.60. Metrics include a recent squeeze score of 3, short interest of 25, and a Financial Health score of 9, indicating relative stability despite modest social chatter and no active options market.

Recently, CGTL announced plans to expand its digital solutions portfolio into AI-driven analytics for small businesses, aiming to drive revenue diversification. While the stock has been volatile, analysts say the new initiative could unlock higher-margin opportunities in emerging markets.

Windtree Therapeutics (WINT)

Windtree Therapeutics finished at $0.49, falling 5.90%. The stock ranks high on squeeze potential with an 89.2% squeeze ability and a juice target of $4.30. It sports a recent squeeze score of 18, significant short interest of 24, and a Financial Health score of -3, signaling ongoing financial concerns.

Windtree has been in focus after reporting progress in its heart failure drug trial, though the data was early-stage. Investors remain cautious given Windtree’s cash burn and possible future dilutions, but the high short interest keeps it on squeeze-watch lists.

ImmunityBio (IBRX)

ImmunityBio traded at $2.62, dipping 0.80%. Its squeeze ability sits at 77.8%, with a lofty juice target of $15.10. It boasts a recent squeeze score of 20, short interest at 17, and a Financial Health score of 8, reflecting a healthier balance sheet.

ImmunityBio recently disclosed updated results for its cancer immunotherapy pipeline, showing positive signals in bladder cancer treatment. Investors are eyeing regulatory progress closely, as successful trials could dramatically shift the company’s valuation.

AirSculpt Technologies (AIRS)

AirSculpt Technologies held steady at $4.83. Its squeeze ability measures 65.4%, with a juice target of $13.70. It posted a recent squeeze score of 16, has a short interest of 15, but a Financial Health score of -7, indicating balance sheet strain.

The company made headlines by expanding into two new U.S. markets, betting on sustained demand for minimally invasive cosmetic procedures. Despite solid revenue growth, concerns linger over rising costs and competition in the aesthetics space.

1-800-Flowers.com (FLWS)

1-800-Flowers.com rose 3.70% to $5.10. It shows a squeeze ability of 75.5% and a juice target of $31.50. The recent squeeze score is a strong 20, short interest is at 13, and Financial Health is slightly negative at -1.

The company recently announced strategic partnerships to boost AI personalization in online gifting. Management believes this could help recapture market share lost to broader e-commerce players. Investors are weighing the benefits of tech investments against weaker consumer spending trends.

B. Riley Financial (RILY)

B. Riley Financial gained 1.30% to close at $3.01. Its squeeze ability is 76.8%, with a juice target of $19.00. The stock has a recent squeeze score of 20, short interest at 12, and a solid Financial Health score of 8.

In recent news, B. Riley disclosed further asset sales aimed at deleveraging its balance sheet following earlier liquidity concerns. Investors are monitoring the firm’s transition from aggressive acquisitions to financial discipline, which could bolster confidence in the long run.

Newegg Commerce (NEGG)

Newegg Commerce advanced 2.60% to $16.66. It carries a squeeze ability of 72.5%, with a juice target of $15.20. It logs a recent squeeze score of 20, short interest at 25, and a Financial Health score of 8, signaling moderate financial strength.

Newegg recently announced a major partnership to integrate AI-powered product recommendations across its e-commerce platform, seeking to boost conversion rates. The stock remains heavily shorted amid debates over e-commerce competition and margin pressures.

Rocket Companies (RKT)

Rocket Companies held flat at $14.18. Its squeeze ability is 71.0%, with a juice target of $88.90—a significant upside potential. Rocket shows a recent squeeze score of 20, short interest at 20, but a Financial Health score of -8, reflecting ongoing financial stress.

Rocket just reported stronger-than-expected mortgage origination volumes, hinting at resilience despite higher rates. Analysts remain divided on the sustainability of volumes in a challenging housing market, but shorts have piled on due to Rocket’s exposure to macroeconomic swings.

NewGenIvf Group (NIVF)

NewGenIvf Group soared 12.50% to $1.17. It carries a squeeze ability of 70.9%, with a juice target of $6.40. It holds a recent squeeze score of 1, short interest at 0, and a Financial Health score of 10, indicating solid fundamentals.

NewGenIvf made waves with its expansion into Southeast Asia, where fertility services are in growing demand. Management sees a major growth runway, but investors are cautious about regulatory hurdles and cultural barriers in the fertility market.

Wolfspeed (WOLF)

Wolfspeed surged 88.10% to $0.75. It’s one of the strongest names on the list with an 80.6% squeeze ability and a juice target of $2.80. Wolfspeed has a recent squeeze score of -14, indicating recent weakness, but boasts a short interest of 20 and a Financial Health score of 2.

Wolfspeed has been in the spotlight after securing a new supply deal with an EV manufacturer for silicon carbide semiconductors. Despite the positive contract news, the stock remains volatile as the company grapples with high capital expenditures tied to ramping up manufacturing capacity.

Comments are closed