Squeezefinder 13OCT2025

October 13, 2025

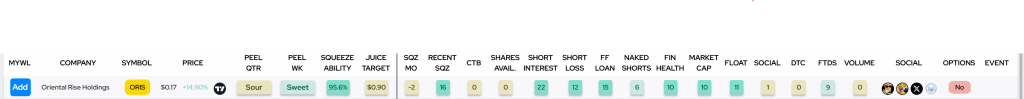

Oriental Rise Holdings (NASDAQ: ORIS) has officially hit Squeeze Finder’s Golden Ticker filter, putting it on the radar for traders watching potential short-squeeze setups. The latest scan data shows the stock is “extremely ready,” showing one of the strongest technical and sentiment profiles in the market right now.

ORIS by the Numbers

According to Squeeze Finder’s proprietary metrics (as of October 13, 2025):

- Price: $0.17 (+14.9%)

- Squeeze Ability: 95.6 %

- Juice Target: $0.90

- Recent Squeeze Count: 16

- Short Interest: 22 score

- Short Loss: 12 score

- Naked Shorts: 6 score

- Float: 11 score (extremely low float environment)

- Financial Health: 10 score

- Market Cap: 10 score

- Failure to Deliver (FTDs): 9 score

In short — ORIS checks nearly every box for a classic squeeze setup. The algorithm classifies its PEEL Wk as “Sweet” and PEEL Qtr as “Sour,” meaning the short-term momentum has flipped bullish after a period of cooling, often a precursor to a volatile breakout.

A Squeeze That Already Happened — and May Be Coiling Again

ORIS already ran once, delivering a sharp squeeze earlier this quarter as shorts scrambled to cover. Since then, the chart has been compressing — price ranges tightening between roughly $0.13 and $0.19 — forming what technical traders call a coil pattern.

This kind of volatility contraction often precedes a new breakout move. If volume spikes or shorts start to cover again, that coil could unwind violently to the upside.

Given the 95 %+ squeeze readiness score, minimal float, and high short metrics, ORIS might be entering a second-stage setup — the kind of scenario where early recognition is key.

Why Traders Are Watching

Squeeze Finder’s Golden Ticker tag only lights up for symbols that align across multiple categories — short pressure, liquidity, volume, float, sentiment, and prior squeeze behavior. ORIS scoring at the top of nearly all of them means:

- Shorts are under pressure again.

- The stock is technically coiled near resistance.

- Sentiment and visibility are turning bullish in short-term scans.

The last time this happened, the move was rapid and caught many traders off-guard. With the algorithm now flagging ORIS as “extremely ready,” eyes are back on this tiny ticker to see whether history repeats itself.

Disclaimer: This post is for informational and educational purposes only and not financial advice. Micro-cap stocks like ORIS can move violently in both directions and carry significant risk.

Comments are closed